In my previous post I have discussed about my thoughts on money and how people’s perception is changing towards it.

In this post I will share my views on investments through various means like equities, gold, cryptocurrencies and more.

From where I belong I used to believe that saving money is peoples main objective. Here are some of them:

- Bank FD’s/RD’s

- Physical Gold

- Some Pension fund in post office or in some small finance urban banks

I also believed the same till I was 22. Thought I have to save money else I would end up broke and buying an home would just remain a day dream.

One day while I was waiting to pierce through an bored evening YouTube recommended me an investment video of Ankur Warikoo. (Here’s the link if you also want to see that video:

I never heard of him till that point and once I saw this video I went on a walk and thought all my years I was living under a rock, and how my thoughts on money were primeval. I thought for long and looked back at my dense decisions which I made while purchasing products services which I really have not needed at that point of time.

And I had invested all the money instead of purchasing not so essential products/services I could have easily made more than ~2 lacs.

From that point I let my intuition guide me to get better in personal finance. I went on consuming more and more knowledge of money, where I learned many lessons. Became frugal in my spending.

I did knew somethings about stocks and investing mainly through entertainment like Scam 1992, The Wolf of Wall Street and many more.

But YouTube is the one which really showed me the depths of finance, read books which I got suggestions through various videos and articles (if you want to know about them check my previous post 😉)

After watching so copious amounts of financial clips I was more than convinced to Start my Investment Journey.

And finally on 4th of April I opened my DEMAT account with Zerodha and bought my first basket of shares through Smallcase

A smallcase is an intelligently weighted basket of upto 50 stocks that reflects a theme, idea or strategy.

I bought a smallcase named The Naked Trader, which is created on the basis of investment criteria set out by Robbie Burns, a UK-based trader, in his book ‘The Naked Trader: How Anyone Can Make Money Trading Shares’. (Not a recommendation)

The Day I bought the shares/stocks I was overwhelmed by even the tiny moments in the stock price, and once that P/L was in green(In Profit) I was thrilled to see my hard earned money grow.

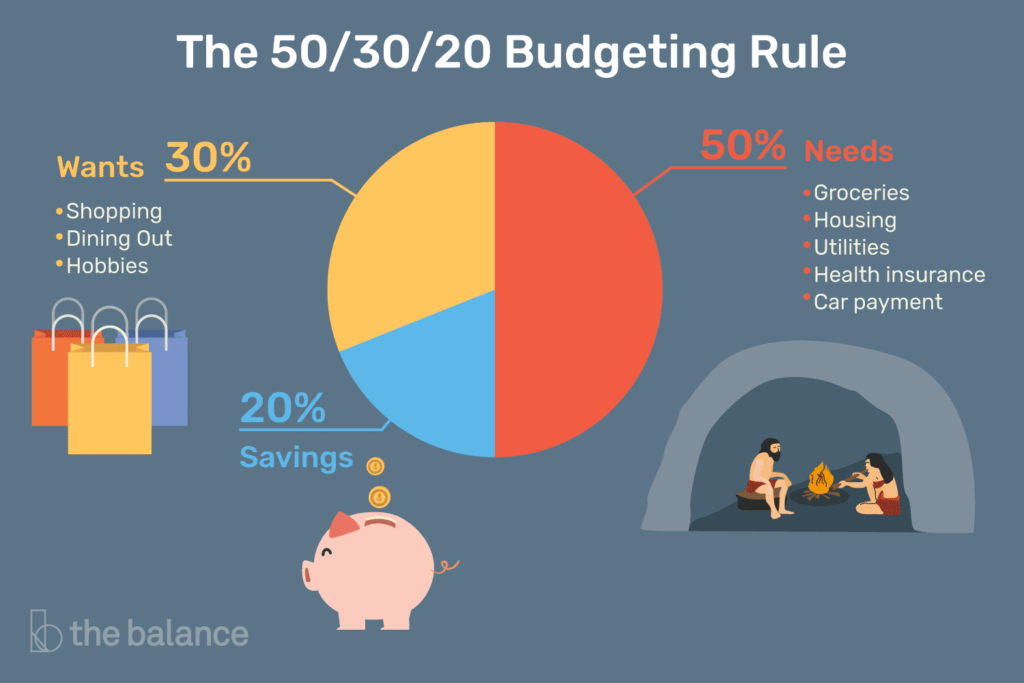

From that point I decided to invest more and more and followed 50-30-20 rule for my savings.

The 50/30/20 rule is an easy budgeting method that can help you to manage your money effectively, simply and sustainably. The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants and 20% for savings or paying off debt.

I will make another post on these measures which I am still learning.

I have been investing since past 6 months and getting to know the various aspects of Stock market and other means of investing.

In these 6 months I have seen just a few crashes and the market is in going briskly and touching it’s all time high several times throughout this period.

If you are reading this far I urge you also to start investing and and see the difference on how money works .

Fun Fact: Wipro stock price in 1980 was around 100 rupees but now its about ~650 rupees. If someone invested 10,000 rupees in Wipro and bought 100 shares of Wipro company back in the day. Now Wipro share price is 650 Rupees 650×19200000 =12,48,00,00,000 Rs.

Guess, you give some thought to it 😉 and imagine the above hypothetical situation.

I will research further and update on hoe to invest and various aspects of it.

Till then I hope you guys a great time ahead.

By,