The topic for this post is “Can Crypto be considered as an Asset Class”, we will discuss what an Asset class is and points while considering crypto as an asset class, the pros and cons.

Till now we have heard about asset classes like Equities, Real Estate, Precious metals and may more.

Nowadays there is a new debate in the financial sector on whether or not crypto can be considered as an Asset or Not. Let’s find out:

Does Crypto currency falls under the definition of Asset Class?

First lets see what an asset class is:

An asset is anything that you own. A liability is something that you owe.

An asset can be anything: livestock, gold, stocks, bonds, collectables, art, copyrights, trademarks, and so and so forth.

Some assets (bonds, for example) pay you in the form of interest when you own them, some (art, for example) don’t. The basic purpose of owning an asset is to transmit wealth through time.

If we look at fixed income asset classes for example Bonds, PPF, NPS, Fixed Deposits, Debt Mutual Funds etc. Which generate an Income and they are just money in the form of loans given to others and they have very strict rules and regulations which are imposed by various financial institutions and the government.

The same thing can be said about the Real Estate, where the Land, Bungalow, REIT and commercial properties all are physical spaces whose prices go up and down manually.

Can we say the same for various cryptocurrencies too?

A cryptocurrency is a digital medium of exchange using strong cryptography to secure financial transactions, control the creation of additional units and verify the transfer of assets.

Though many are not sure if we can even call cryptocurrencies as a “Store of Value” unlike other assert classes.

Also there is no common agreement on how various countries regulate the use of cryptocurrencies. While countries like El Salvador made Bitcoin a legal tender, many other countries still see this as just a currency and countries like China have gone so far to blanket ban cryptocurrencies.

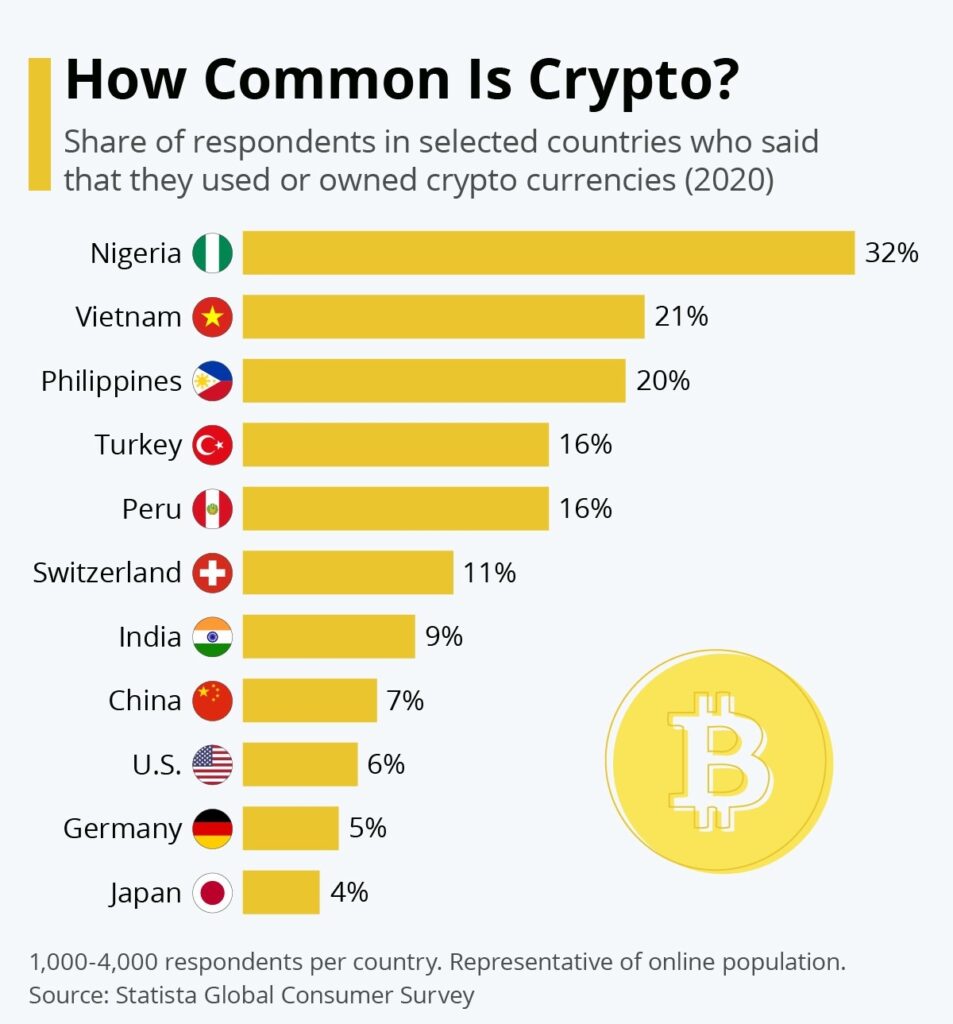

Many of the users nowadays are buying crypto currencies for just speculative reasons and not for the fundamental values where they want it to grow because of the fundamental values or any economical values

How Speculative is Crypto asset and what causes the volatility

There are several arguments regarding crypto being a speculative asset.

Firstly new technology goes through the rapid speculative phase at the beginning, the best example would be the rise of internet in the 2000’s people were very speculative as the tech bubble burst in the early 2000’s.

Secondly crypto is looked with curiosity in India as a viable source of income in India, where its access is being heavily regulated by the government.

Thirdly the bitcoin kind off mimics the stocks and currencies.

However the speculation continues as crypto’s image as a gambling asset, continued hunt for economic opportunities and the widespread availability of the internet.

Concentration of crypto assets in early investors can lead to price crashing if they wish to liquidate their holdings

In the early days of crypto, the early investors got a big chunk of the crypto assets which have grown to huge amounts and made them rich over the period of time. Some people call them “Whales”.

If these whales wish to sell their holdings then it will be reflected in the market as the price may crash down.

The Basis of classifying Crypto as an Asset Class

Is crypto a peer-to-peer decentralized cash system or means to earn short term money?

Only the time will tell. Already majority of the people in India consider it as a short term money making asset.

Anyways crypto will keep on growing till it reaches its maturity and reaches some kind of stability. Till then we can only speculate the Growth/Decline.

Feel free to reach out in case of any feedback or concerns.