Growing up in an Indian middle class household my parents were very conservative about money and it’s aspects. When I was little I did not had any knowledge or to be precise I was not aware of the true value of money. I was that kid who wanted everything he lays his eyes on no matter what the situation is. Now when I think of what all thing I’ve done I feel so much guilty.

Some say time changes people, guess that’s true in my case. Well I still don’t completely understand the true value or the concept of it, but through some very helpful YouTube videos, some articles and some books I am getting to know bit by bit. Though still a long way to go.

Advantages of growing in an Indian family is you get frugal in spending money from pretty much inception of your life. Well if you don’t believe just on a shopping tour with your guardians, it awaits lots of fun/uncanny events if you never been one before. But most of us do not get the reason on why they are going that far to save couple of bucks, doesn’t make sense then. But trust me once you will start to earn and you have things to take care it’ll make much more sense. Some exceptions are there well if you are spoon fed in a golden spoon it’s pretty hard to understand.

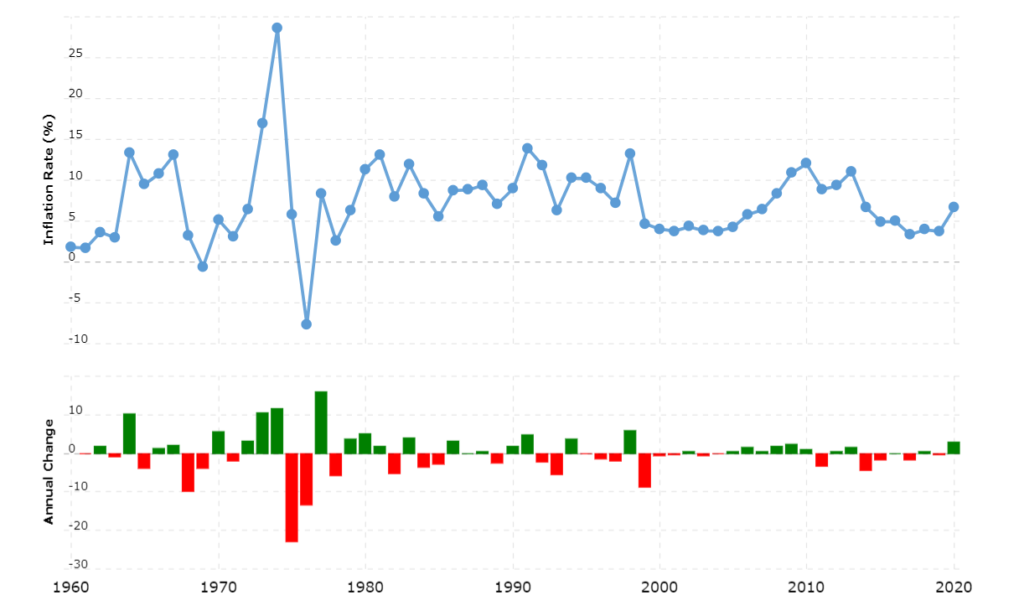

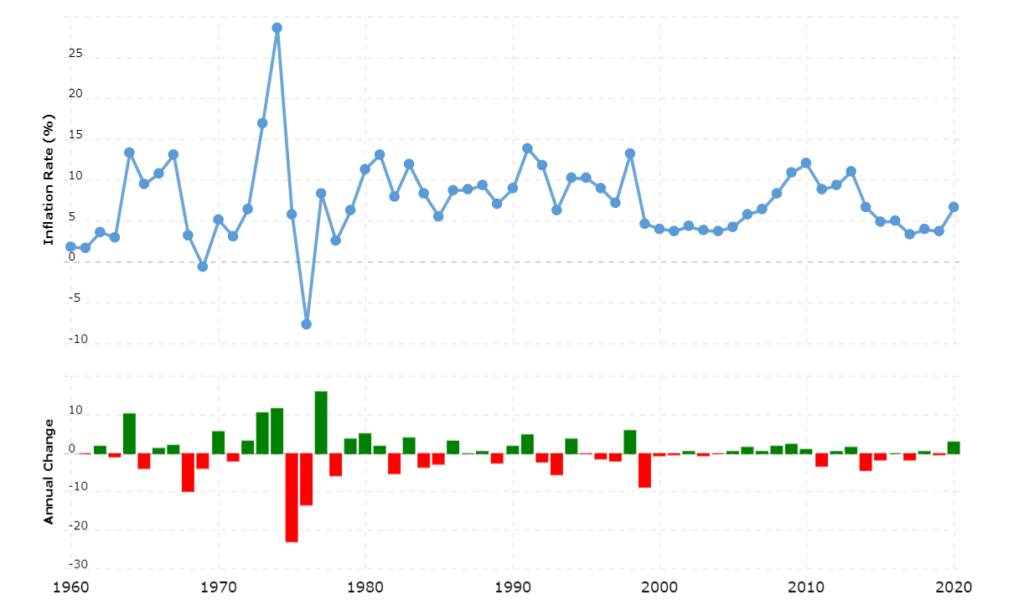

Now if we think of reality and look into money with its solemnities we will be at a loss words. Just look ant the below chart at India’s inflation rate: (Currently India’s Inflation rate sits at ~6%)

For, those of you who don’t know what inflation is here’s the definition:

Inflation is the decline of purchasing power of a given currency over time. A quantitative estimate of the rate at which the decline in purchasing power occurs can be reflected in the increase of an average price level of a basket of selected goods and services in an economy over some period of time. The rise in the general level of prices, often expressed as a percentage, means that a unit of currency effectively buys less than it did in prior periods.

In simple terms, if you have 100Rs. today next year that 100Rs. will be just worth ~94Rs. Then 6% of 94Rs. next year.

We all have to be ready for inflation and some significant pandemics such as COVID19 which took the whole world by storm and millions of people lost their loved ones and many more lost their livelihood.

People who are still sitting without any tension unless you are already WEALTHY AND NOT RICH have to think of our financials.

I am not saying I’m any good at this. I also got to know about all these things recently. Having read some of the most revered books in finance which are,

Rich Dad Poor Dad: By Robert Kiyosaki

Psychology of Money: By Morgan Housel

The Intelligent Investor: By Benjamin Graham

One Upon Wall Street: By Peter Lynch

All of these books have life lessons of these great people. If you get time then try to read them else at least the audio book, I bet You will get to learn something new.

One of my favorite line was :

Once you get the paycheck from others you are in the rat race your growth is stuck in others hands.

People say it is say to become rich rather than staying one or rather being wealthy.

For example there was a yearly sale on Flipkart Indian online shopping portal which had mouth watering discounts on numerous products.

As I said above, my 10 year old brain started browsing through Flipkart’s catalogue and suddenly my eyes stuck on shiny iPhone 12 which had an massive price cut and was available at 49,999 Rs.

And stupid me gathered my hard earned 50,000 and ordered the phone even though I had an perfect working phone. And after ordering I felt guilty and I had no more interest in using iPhone. Later I cancelled the order and got my money back. And i am happy about my decision.

I then realized how hard it is to spend hard earned money on things which we really don’t need at that particular moment.

All I am saying is to avoid such situations and shortfalls of money we have to be prepared for the future, so that we could have at least some money which we can spend on our wants. For that we have to start saving/investing from this moment. We have to beat that ~6% inflation anyhow else it is of no use. We keep on earning and losing that hard earned money to inflation. Someone said,

Inflation is a tax which no one realize, yet they fall prey to that inevitable tax.

So, we have to find a way to grow our money at a rate more than that of inflation i.e ~6% In a typical Indian household some of the best means of investments are: Physical Gold, Bank FD’s/RD’s which are okay to protect our money but they in no means help us grow it.

Bank FD’s hardly give 5-6% interest which is not even enough to beat inflation. Following are some top tier bank FD interest rates:

Physical Gold well it is best as jewelry but not as an investment as it has making charges:

So, one may ask what are the feasible options, well there are plenty of them namely,

- Equity

- Digital gold/SGB(Sovereign Gold Bonds)

- Real Estate

There are plenty more I will update once I get to know of them.

All the above are more risky and not as much as liquid as FD or physical gold but these are way better to grow your money.

I will try to write about them once I better understand them.

Though one no brainer investment could be Index Fund.

An index fund is a type of mutual fund or exchange-traded fund (ETF) with a portfolio constructed to match or track the components of a financial market index, such as the NIFTY50/SENSEX. An index mutual fund is said to provide broad market exposure, low operating expenses, and low portfolio turnover. These funds follow their benchmark index regardless of the state of the markets.

In simple terms Index fund tracks a certain benchmark. So, you are basically betting on certain sectors or in some cases growth of a country. Historically speaking Index funds have performed well even after recessions, wars, pandemics. Check the below chart of an flagship index from Indian Stock Market i.e. NIFTY50:

In it’s lifetime NIFTY has gone up by unbelievable 1,897% and it’ll reach even more soaring heights.

And we can safely bet on India’s future.

I will try to make another post regarding the investments.

With that I will end this post here or probably I will edit later 😜

By,